Diksia.com - Investing in the stock market can be a rewarding way to grow your wealth and achieve your financial goals. However, many people think that they need a lot of money to start investing, or that they have to buy whole shares of expensive stocks like Amazon or Tesla. This is not true. Thanks to a feature called fractional shares, you can invest in stocks and ETFs with as little as $25 and no commissions.

In this article, we will explain what fractional shares are, how they work, and why you might want to use them. We will also compare etrade fractional shares with other brokers that offer this feature, and highlight some of the pros and cons of investing with fractional shares.

What are fractional shares?

Fractional shares are pieces of a whole share of a stock or an ETF. For example, if a stock costs $100 per share, you can buy a fraction of it, such as 0.1 share for $10, or 0.5 share for $50. This way, you can invest in any stock or ETF that you want, regardless of the price per share. You can also diversify your portfolio by buying fractions of multiple stocks or ETFs with a small amount of money.

Fractional shares are not a new concept. They have been around for a long time as part of dividend reinvestment plans (DRIPs), which allow investors to automatically reinvest their dividends to buy more shares of the same stock, including fractional shares. However, in recent years, some online brokers have started to offer fractional shares as a standalone feature, allowing investors to buy and sell fractions of any stock or ETF that they offer.

How do etrade fractional shares work?

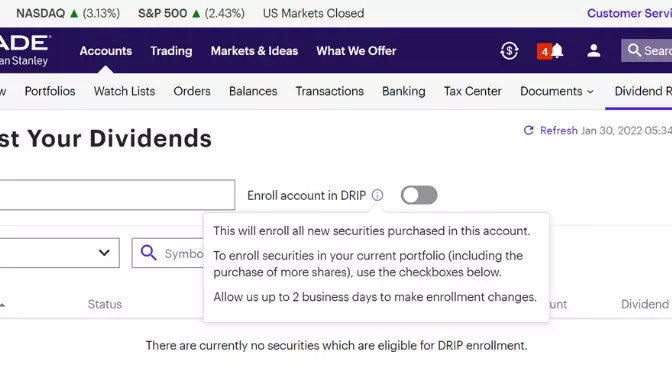

Etrade is one of the online brokers that offer fractional shares, but only within their DRIP. This means that you can only buy fractional shares of the stocks or ETFs that pay dividends, and only when you reinvest your dividends. You cannot buy or sell fractional shares of any other stock or ETF, or with any other source of funds.

To use etrade fractional shares, you need to enroll in their DRIP, which is free and easy to do. You can enroll in the DRIP for individual stocks or ETFs, or for your entire portfolio. Once you are enrolled, you will receive your dividends in cash, and then etrade will use that cash to buy more shares of the same stock or ETF, including fractional shares. You will see the fractional shares in your account, and you will receive dividends on them as well.

Etrade fractional shares have some advantages and disadvantages. On the positive side, they allow you to:

- Invest in high-priced stocks or ETFs that pay dividends, such as Apple or Vanguard S&P 500 ETF, with a small amount of money.

- Compound your returns by reinvesting your dividends automatically and buying more shares over time.

- Save on commissions, as etrade does not charge any fees for buying or selling fractional shares within the DRIP.

On the negative side, they also have some limitations, such as:

- You cannot buy or sell fractional shares of any stock or ETF that does not pay dividends, or with any other source of funds, such as deposits or transfers.

- You cannot specify the price or the time of your fractional share purchases or sales, as they are executed by etrade at their discretion.

- You may have tax implications, as you will have to report your dividends and capital gains or losses on your fractional shares.

How do etrade fractional shares compare with other brokers?

Etrade is not the only broker that offers fractional shares. In fact, some other brokers offer more flexibility and features than etrade when it comes to fractional shares. For example, Charles Schwab, Fidelity, Interactive Brokers, Robinhood, TD Ameritrade, and Tastytrade all allow you to buy and sell fractional shares of any stock or ETF that they offer, not just the ones that pay dividends.

They also let you use any source of funds, such as deposits or transfers, to buy fractional shares, and they let you choose the price and the time of your transactions. Some of them also have minimums as low as $1 or $5 to buy fractional shares, compared to etrade’s minimum of $25.

However, these brokers also have some drawbacks, such as:

- They may not offer fractional shares for all the stocks or ETFs that they offer, or they may limit the number of fractional shares that you can buy or sell per day or per order.

- They may not offer fractional shares for some types of securities, such as options, futures, or foreign stocks.

- They may not offer fractional shares for some types of accounts, such as IRAs, 401(k)s, or custodial accounts.

- They may have different methods of calculating and rounding the fractional shares, which may affect your returns and taxes.

Therefore, before you choose a broker for fractional shares, you should compare their features, fees, and limitations, and see which one suits your needs and preferences the best.

Conclusion

Fractional shares are a great way to invest in the stock market with little money and no commissions. They allow you to buy and sell pieces of any stock or ETF that you want, regardless of the price per share. They also help you diversify your portfolio and compound your returns over time.

Etrade offers fractional shares, but only within their DRIP. This means that you can only buy fractional shares of the stocks or ETFs that pay dividends, and only when you reinvest your dividends. You cannot buy or sell fractional shares of any other stock or ETF, or with any other source of funds.

If you are looking for more flexibility and features, you may want to consider other brokers that offer fractional shares, such as Charles Schwab, Fidelity, Interactive Brokers, Robinhood, TD Ameritrade, or Tastytrade. They allow you to buy and sell fractional shares of any stock or ETF that they offer, not just the ones that pay dividends. They also let you use any source of funds, such as deposits or transfers, to buy fractional shares, and they let you choose the price and the time of your transactions.

However, you should also be aware of the drawbacks and limitations of fractional shares, such as tax implications, rounding errors, and availability issues. You should also compare the features, fees, and restrictions of different brokers, and see which one fits your goals and style the best.