Diksia.com - If you are looking for an online platform to invest, trade, or manage your finances, you might have heard of ETRADE. ETRADE is one of the largest and most popular online brokerages in the US, with over 7 million customers and $10.8 billion in market capitalization. But what is ETRADE exactly, and what does it offer to its clients? In this article, we will explore the history, features, and performance of ETRADE, as well as its ticker symbol and stock price.

The History of E*TRADE

ETRADE was founded in 1982 by William A. Porter and Bernard A. Newcomb as a discount brokerage firm. The company initially offered online trading services through a dial-up connection, and later expanded to include web and mobile platforms. ETRADE was one of the pioneers of online investing, and benefited from the dot-com boom in the late 1990s and early 2000s.

However, ETRADE also faced several challenges and crises throughout its history, such as the dot-com bust, the 2008 financial crisis, and the 2020 coronavirus pandemic. The company had to overcome losses, lawsuits, and regulatory issues, as well as competition from other online brokerages and fintech startups. ETRADE also underwent several acquisitions and mergers, the most recent one being with Morgan Stanley in 2020.

The Features of E*TRADE

E*TRADE offers a range of financial products and services to its clients, including:

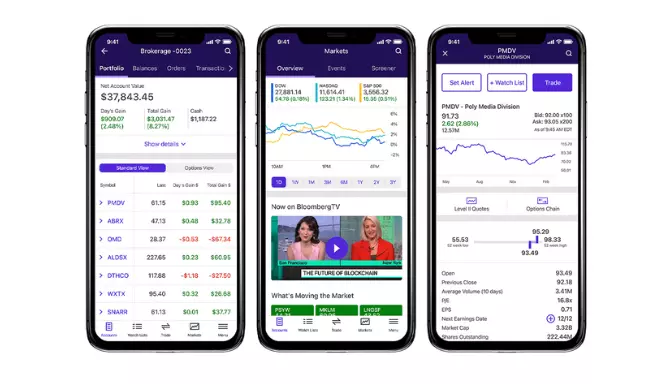

- Brokerage accounts: ETRADE allows its clients to trade stocks, options, ETFs, mutual funds, futures, and bonds, with $0 commissions on online US-listed stock, ETF, mutual fund, and options trades. ETRADE also provides access to international markets, IPOs, and pre-market and after-hours trading.

- Banking products: ETRADE offers savings and checking accounts, as well as debit cards and ATM access, through its subsidiary ETRADE Bank. The bank accounts are FDIC insured and offer competitive interest rates and low fees.

- Managed portfolios: E*TRADE offers automated investment management services through its Core Portfolios program, which creates and maintains a diversified portfolio of ETFs based on the client’s risk profile, goals, and preferences. The program charges a low annual advisory fee of 0.30% and requires a minimum investment of $500.

- Retirement accounts: ETRADE helps its clients plan and invest for their retirement, with various account types such as IRAs, Roth IRAs, rollover IRAs, and small business retirement plans. ETRADE also provides retirement planning tools, education, and guidance.

- Stock plans: ETRADE administers stock plans for employees and executives of companies that offer equity compensation, such as stock options, restricted stock units, and employee stock purchase plans. ETRADE helps its clients manage their stock plan accounts, exercise their options, and sell their shares.

The Performance of E*TRADE

ETRADE’s ticker symbol is ETFC, and it is listed on the NASDAQ stock exchange. As of January 1, 2024, the stock price of ETRADE was $49.26, and the 52-week range was $48.91 to $51.18. The company had a market capitalization of $10.8 billion, a revenue of $3.06 billion, and an earnings per share of $3.45. The company also had a price-to-earnings ratio of 14.30 and a beta of 1.17.

ETRADE’s stock performance has been influenced by various factors, such as the merger with Morgan Stanley, the growth of online investing, the volatility of the financial markets, and the impact of the coronavirus pandemic. ETRADE’s stock has been relatively stable and consistent, but also faced some fluctuations and challenges.

The Future of E*TRADE

ETRADE is expected to continue to grow and innovate as an online brokerage, especially after the merger with Morgan Stanley, which will provide more resources, capabilities, and opportunities for the company. ETRADE will also face more competition from other online brokerages, such as Robinhood, Schwab, and TD Ameritrade, as well as from new entrants and disruptors in the fintech space.

ETRADE will have to adapt to the changing needs and preferences of its clients, as well as to the evolving trends and regulations in the financial industry. ETRADE will also have to maintain its reputation and trust among its customers, as well as its quality and reliability of its products and services.

ETRADE is a well-known and respected online brokerage that offers a variety of financial products and services to its clients. ETRADE has a long and rich history, a wide and diverse range of features, and a solid and stable performance. ETRADE also has a bright and promising future, as it aims to provide more value and benefits to its customers and shareholders. If you are interested in investing, trading, or managing your finances online, you might want to consider ETRADE as your partner and platform.