Diksia.com - Are you looking for a way to test your options trading ideas before putting real money on the line? Do you want to see how your options strategies would have performed in the past and how they are likely to perform in the future? If so, you might be interested in tastytrade’s lookback feature, a powerful and free tool that lets you backtest your options strategies with historical data and trade simulation.

What is tastytrade?

Tastytrade is an online financial network that provides educational and entertaining content on options trading, investing, and personal finance. Tastytrade also offers a brokerage platform called tastyworks, where you can execute your options trades with low commissions and fees. Tastytrade’s mission is to empower individual investors to take control of their financial future and trade with confidence.

What is lookback?

Lookback is a new feature on tastytrade that allows you to backtest your options strategies with historical data and trade simulation. Lookback lets you simulate any options strategy, real or imagined, with a near unlimited number of legs matching the delta of the legs of your simulated positions. You can choose from over 2,000 symbols with between 12-15 years of history and see how your strategy would have performed in different market conditions. You can also see your win rate, total number of trades executed, average profit per trade, and more.

How to use lookback?

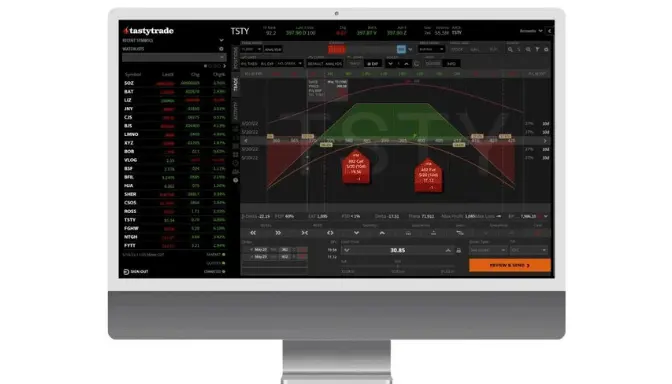

To use lookback, you need to have a tastytrade account and log in to the website. Once you are logged in, you can access lookback from the top menu bar or from the link here. You will see a page like this:

On this page, you can enter the symbol of the underlying asset that you want to trade options on, such as SPY, AAPL, or TSLA. You can also choose the expiration date, the strike price, and the type of option (call or put) for each leg of your strategy. You can add or remove legs as you wish, and you can also adjust the quantity and the price of each leg. You can also choose to enter a custom delta for each leg, or let the system calculate it for you based on the current market price.

Once you have entered your strategy, you can click on the “Backtest” button to see the results. You will see a page like this:

On this page, you can see the details of your strategy, such as the net debit or credit, the max profit and loss, the break-even point, and the greeks. You can also see a graph that shows the profit and loss at expiration and on the day for your strategy. You can use the slider above the graph to adjust the date or the price and see how your profit and loss change with time and price. You can also check the boxes at the top to see how your delta and theta change with time and price.

You can also click on the “Advanced” button at the top to see more statistics about your strategy, such as the cumulative percent and the P/L bell curve. The cumulative percent line shows the likelihood of you receiving a certain amount of profit/loss or greater, with the percent being on the y-axis. The P/L bell curve line shows the distribution of profit/loss, with the P/L being on the x-axis. You can use the slider above the graph to adjust the date and see how the probability and the distribution change with time.

Why use lookback?

Lookback is a useful tool for options traders who want to test their trade ideas and see how they would have performed historically and before committing money on the trade. Lookback can help you:

- Evaluate the risk and reward of your options strategies and compare different strategies

- Optimize your options strategies by adjusting the variables such as expiration date, strike price, and delta

- Learn from your past trades and improve your future trades

- Gain confidence and experience in options trading

Conclusion

Tastytrade’s lookback feature is a powerful and free tool that lets you backtest your options strategies and analyze your success rate with historical data and trade simulation. Lookback can help you evaluate, optimize, learn from, and gain confidence in your options trading. If you are interested in options trading and want to test your trade ideas, you should give lookback a try and see how it can improve your trading performance.