Diksia.com - T. Rowe Price Group, Inc. (TROW) is one of the largest and most respected asset management firms in the world. The company provides a wide range of investment products and services for individual and institutional investors, including mutual funds, retirement plans, advisory services, and more. TROW stock is also a dividend aristocrat, meaning it has increased its dividend for at least 25 consecutive years. In fact, T. Rowe Price has raised its dividend for 35 years in a row, making it one of the most reliable dividend payers in the market.

In this article, we will examine the reasons why TROW stock is a solid investment for income seekers. We will look at the company’s financial performance, competitive advantages, growth prospects, valuation, and dividend history. We will also compare TROW stock with some of its peers in the asset management industry and see how it stacks up.

Financial Performance

T. Rowe Price has a proven track record of delivering strong financial results, even in challenging market conditions. The company has grown its revenue, earnings, and assets under management (AUM) consistently over the past decade, as shown in the table below.

| Year | Revenue | Earnings | AUM |

|---|---|---|---|

| 2013 | $3.5B | $1.1B | $692B |

| 2014 | $4.2B | $1.2B | $746B |

| 2015 | $4.2B | $1.2B | $763B |

| 2016 | $4.2B | $1.2B | $810B |

| 2017 | $4.8B | $1.5B | $991B |

| 2018 | $5.4B | $1.8B | $972B |

| 2019 | $5.6B | $2.1B | $1.2T |

| 2020 | $6.0B | $2.3B | $1.3T |

| 2021 | $6.8B | $2.6B | $1.6T |

Source: T. Rowe Price Group, Inc. (TROW) Stock Price, News, Quote & History – Yahoo Finance

As you can see, T. Rowe Price has increased its revenue and earnings by more than 90% and 130%, respectively, since 2013. The company has also nearly doubled its AUM from $692 billion to $1.6 trillion in the same period. This impressive growth reflects the company’s ability to attract and retain clients with its diversified and high-quality investment offerings, as well as its efficient and scalable business model.

Competitive Advantages

T. Rowe Price has several competitive advantages that set it apart from its rivals and enable it to generate superior returns for its shareholders. Some of these advantages are:

- Brand reputation and trust: T. Rowe Price is a well-known and respected name in the asset management industry, with a history dating back to 1937. The company has built a reputation for delivering consistent and superior investment performance, as well as providing excellent customer service and advice. The company has also won numerous awards and recognition for its products and services, such as the Lipper Fund Awards, the Morningstar Fund Awards, and the Barron’s Fund Family Rankings. These factors help T. Rowe Price to attract and retain loyal and satisfied clients, as well as to charge premium fees for its services.

- Investment expertise and culture: T. Rowe Price has a team of more than 600 investment professionals, who have an average of 19 years of industry experience and 14 years of tenure with the company. The company also has a collaborative and long-term oriented investment culture, which fosters innovation and excellence. The company invests heavily in research and technology, as well as in talent development and retention. The company also aligns its interests with its clients and shareholders, by investing its own capital alongside its clients and by having a high level of employee ownership. These factors help T. Rowe Price to deliver superior and consistent investment results, as well as to adapt to changing market conditions and client needs.

- Diversified and global product portfolio: T. Rowe Price offers a broad range of investment products and services, covering various asset classes, geographies, styles, and strategies. The company has more than 200 mutual funds, as well as exchange-traded funds (ETFs), separately managed accounts, retirement plans, advisory services, and more. The company also has a global presence, with offices in 16 countries and clients in more than 50 countries. The company’s diversified and global product portfolio helps it to cater to different client segments and preferences, as well as to capture growth opportunities in emerging markets and new asset classes.

Growth Prospects

T. Rowe Price has ample room for growth, both organically and inorganically. Some of the growth drivers for the company are:

- Rising demand for asset management services: The global asset management industry is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2020 to 2027, reaching $121.7 trillion by 2027, according to a report by Grand View Research. The growth is driven by factors such as increasing wealth creation, aging population, rising financial literacy, and growing adoption of digital platforms. T. Rowe Price is well-positioned to benefit from this trend, given its strong brand reputation, investment expertise, and diversified and global product portfolio.

- Expanding market share and margins: T. Rowe Price has been gaining market share and improving its margins over the past decade, thanks to its superior and consistent investment performance, as well as its efficient and scalable business model. The company has outperformed its peers and benchmarks in terms of investment returns, net inflows, revenue growth, and profitability. The company has also been investing in growth initiatives, such as launching new products, expanding its distribution channels, enhancing its digital capabilities, and entering new markets. These initiatives are expected to further boost the company’s market share and margins in the future.

- Increasing dividend and share repurchases: T. Rowe Price has a history of rewarding its shareholders with increasing dividends and share repurchases. The company has increased its dividend for 35 consecutive years, making it a dividend aristocrat. The company has also repurchased more than $6 billion worth of its own shares since 2013, reducing its share count by more than 20%. The company has a strong balance sheet, with more than $2.5 billion in cash and no debt, which gives it ample flexibility to continue its shareholder-friendly policies.

Valuation

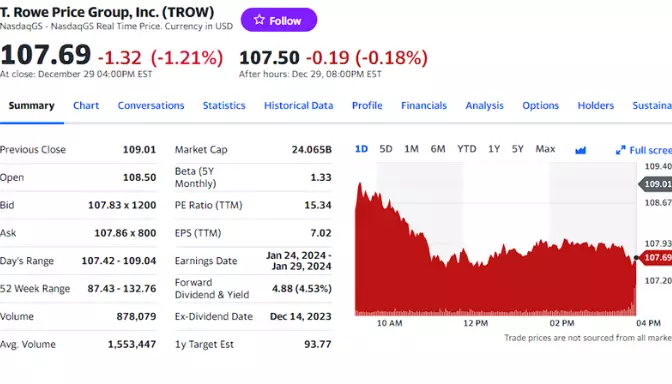

T. Rowe Price is currently trading at a reasonable valuation, compared to its historical averages and its peers. The company has a trailing 12-month price-to-earnings (P/E) ratio of 15.3, which is below its five-year average of 16.4 and its industry average of 18.1. The company also has a forward P/E ratio of 13.9, which implies a 9.2% earnings growth for the next year. The company has a dividend yield of 4.5%, which is above its five-year average of 2.9% and its industry average of 2.6%. The company also has a price-to-book (P/B) ratio of 2.6, which is below its five-year average of 3.1 and its industry average of 3.4.

Dividend History

T. Rowe Price has a long and impressive dividend history, as shown in the chart below.