ETRADE’s stock performance has been influenced by various factors, such as the merger with Morgan Stanley, the growth of online investing, the volatility of the financial markets, and the impact of the coronavirus pandemic. ETRADE’s stock has been relatively stable and consistent, but also faced some fluctuations and challenges.

The Future of E*TRADE

ETRADE is expected to continue to grow and innovate as an online brokerage, especially after the merger with Morgan Stanley, which will provide more resources, capabilities, and opportunities for the company. ETRADE will also face more competition from other online brokerages, such as Robinhood, Schwab, and TD Ameritrade, as well as from new entrants and disruptors in the fintech space.

ETRADE will have to adapt to the changing needs and preferences of its clients, as well as to the evolving trends and regulations in the financial industry. ETRADE will also have to maintain its reputation and trust among its customers, as well as its quality and reliability of its products and services.

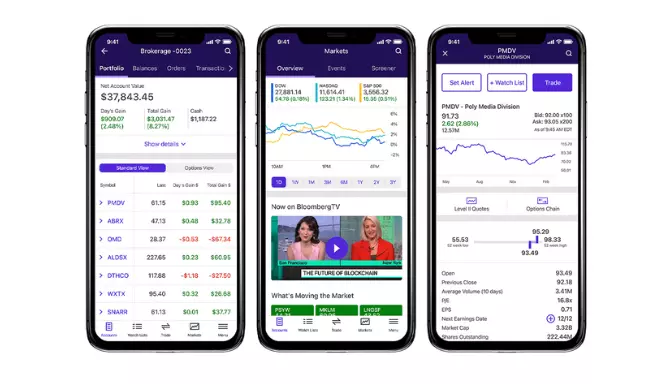

ETRADE is a well-known and respected online brokerage that offers a variety of financial products and services to its clients. ETRADE has a long and rich history, a wide and diverse range of features, and a solid and stable performance. ETRADE also has a bright and promising future, as it aims to provide more value and benefits to its customers and shareholders. If you are interested in investing, trading, or managing your finances online, you might want to consider ETRADE as your partner and platform.